Initiatives to address climate change

Initiatives to address climate change and response to TCFD

The JACCS Group, faithful to its management philosophy of "contributing to the realization of a future inspired by dreams and an affluent society” and in accordance with its "Basic Sustainability Policy," is committed to create a sustainable society and improve its corporate value by contributing to the resolution of environmental and social issues through its business activities. Recognizing that among environmental issues climate change can have a particularly dramatic impact on its customers, franchisees and other business partners and activities, the Group has identified "environmental conservation" as a materiality and is working to reduce its environmental impact. In line with this, in 2023 JACCS has pledged its support for the TCFD (Task Force on Climate-related Financial Disclosures), and its stance with regard to its core elements of "governance," "strategy," "risk management," and "metrics and targets" is detailed below.

Governance

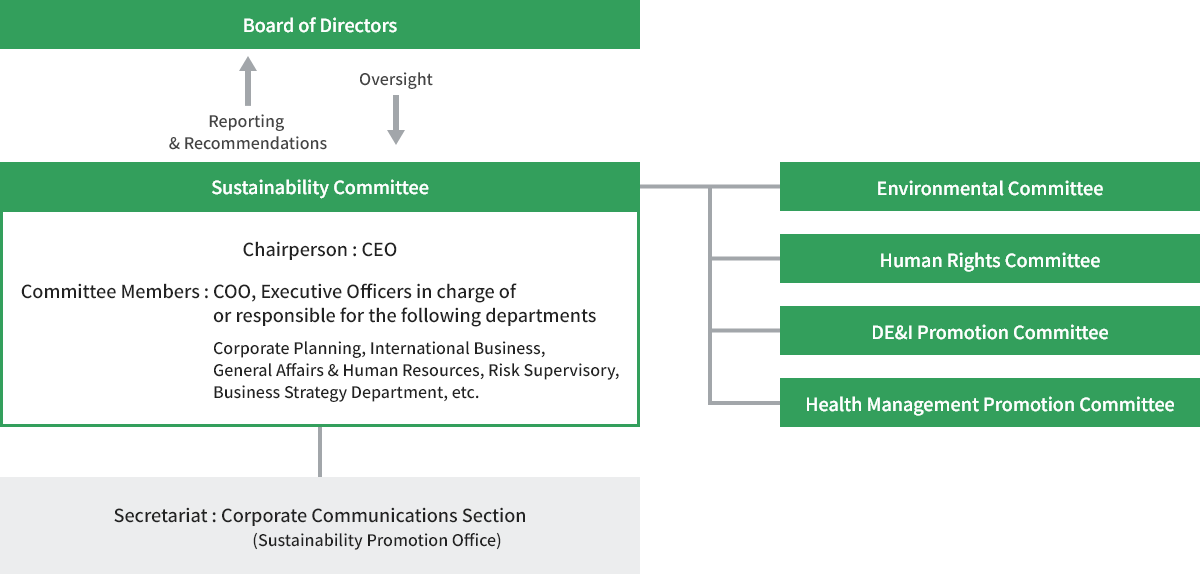

- The JACCS Group regularly deliberates on challenges, response policies, and implementation status regarding environmental and social opportunities and risks, including climate change, in the Sustainability Committee, which is held at least twice per fiscal year.

- Additionally, we have established the Environmental Committee, Human Rights Committee, DE&I Committee, and Health Management Promotion Committee as subsidiary committees, which deliberate on environmental and social initiatives and report important matters to the Sustainability Committee.

- Matters deliberated by the Sustainability Committee are reported and recommended to the Board of Directors, establishing a system where the Board of Directors provides oversight.

Strategy

- The JACCS Group carries out scenario analyses to assess the impact of future climate change on the Company’s business.

- Scenario analysis is conducted assuming multiple climate change scenarios, including the "1.5°C scenario," and medium- to long-term changes in society and the JACCS Group's business environment resulting from climate change are analyzed from the dual perspective of both risks and opportunities.

- The 1.5°C and 4°C scenarios analyzed this time are understood as follows:

└1.5°C scenario

The average temperature rise by the end of this century is limited to approximately 1.5°C compared to pre-industrial levels, and countries actively introduce policies to control climate change. In addition, businesses and consumers are oriented toward decarbonization products and services, and carbon tax is widely implemented. While the economy develops sustainably, its scale is smaller compared to the 4°C scenario. EVs, storage batteries, solar power, and V2H (Vehicle to Home) are widely prevalent. The probability and damage from floods and other disasters are limited compared to the 4°C scenario.

└4°C scenario

The average temperature rise by the end of this century reaches approximately 4°C compared to pre-industrial levels, and countries' policies and business/consumer preferences remain similar to present, with limited implementation of carbon tax and similar measures. The economy remains dependent on fossil fuels, and its scale is larger compared to the 1.5°C scenario. Decarbonization efforts, including transition to EVs, storage batteries, solar power, and V2H, are limited. The probability of floods and other disasters is higher, and damage is greater compared to the 1.5°C scenario.

Risks

Our company's performance may be affected by climate change-related policy and regulatory strengthening, carbon pricing, expansion of market decarbonization orientation, and deterioration of collateral value of financial products due to natural disasters. We recognize that transition risks are likely to materialize in the short to medium term (generally within 10 years), while physical risks are likely to materialize in the long term (generally over 10 years).

| Type of Risk | Summary of Risk | Countermeasures | |

|---|---|---|---|

| Transitional risk | Policies and regulations | Cost increase due to carbon pricing implementation | GHG emissions reduction and supplier engagement toward decarbonization |

| Transitional risk | Market | Decrease in transaction volume and operating revenue due to non-response or delayed response to decarbonization-related products | Enhancement of financial services corresponding to decarbonization-related products |

| Transitional risk | Market | Revenue decrease due to declining demand and market shrinkage for used gasoline car loans accompanying transition from gasoline vehicles to EVs | Enhancement of financial services corresponding to EV proliferation |

| Transitional risk | Reputation | Decrease in business opportunities with partners due to reputation deterioration from insufficient climate change initiatives | Promotion of sustainability-related initiatives including climate change |

| Physical risk | Accute | Owing to natural disasters, security value of the Company’s finance products is impaired, and credit-related expenses increase | Incorporation of natural disaster risks into collateral evaluation |

| Physical risk | Accute | Owing to natural disasters, business operations are suspended at the Company, its member stores and alliance partner stores, and countermeasure and recovery expenses increase | Reflection of increased flood scenarios in BCP |

Opportunity

As opportunities, expansion of handling decarbonization-related and environmentally conscious products is expected. We recognize that opportunities are likely to materialize in the short to medium term (generally within 10 years).

| Type of Opportunity | Summary of Opportunity | Countermeasures |

|---|---|---|

| Products and services | Expansion of handling opportunities for decarbonization-related equipment, materials, and environmentally conscious products (solar power generation, storage batteries, EVs, renovation, V2H, etc.) | Enhancement of financial services corresponding to decarbonization-related products |

| Products and services | Expansion of auto loan-related product sales due to transition/replacement to EVs and other decarbonization technology vehicles | Development and provision of easily accessible financial services for transition and replacement to EVs, etc. |

Risk Management

- The JACCS Group recognizes that climate change-related risk is a significant risk that can impact JACCS's overall management, and that if climate change risks were to materialize, it could have an impact on each risk category in the JACCS Group, mainly credit risk and operational risk.

- The JACCS Group regards risk management as a priority and has established a "Risk Management Committee" under its "Basic Regulations for Risk Management" to comprehensively assess and manage the significant risks affecting the Group. The Committee centrally manages and discusses the status of significant risks, including climate change risk, and reports about them to the Board of Directors and the Management Committee.

Indicators and targets

The JACCS Group uses GHG emissions as an indicator to evaluate the progress of climate change initiatives, and has set GHG emission reduction targets to reduce Scope 1 and 2 by 50% and Scope 3 by 30% by FY2030 compared to FY2019, aiming for net zero in Scope 1, 2, and 3 by FY2050. We are working to reduce GHG emissions through initiatives as diverse as the use of renewable energy and the introduction of eco-friendly company cars.

| CO2Emissions (Unit:tCO2) | |||||||

|---|---|---|---|---|---|---|---|

| FY03/2019 | FY03/2020 | FY03/2021 | FY03/2022 | FY03/2023 | Compared to FY2019 | ||

| Scope1 | 1,731 | 1,621 | 1,809 | 1,809 | 1,533 | マイナス11.4% | |

| Scope2 | 6,012 | 5,834 | 5,405 | 5,062 | 5,450 | マイナス9.3% | |

| Scope1+2 | 7,743 | 7,455 | 7,214 | 6,871 | 6,983 | マイナス9.8% | |

| Scope3 | 595,540 | 494,498 | 393,695 | 422,831 | 418,132 | マイナス29.8% | |

| ①Purchased goods and services | 37,005 | 38,751 | 37,917 | 40,868 | 42,653 | - | |

| ②Capital goods | 19,071 | 15,906 | 14,269 | 16,509 | 14,260 | - | |

| ③Fuel and energy-related activities not included in Scope1 and Scope2 | 1,446 | 1,424 | 1,288 | 1,173 | 1,196 | - | |

| ④Transportation and distribution(Upstream) | 1,889 | 1,856 | 1,668 | 1,400 | 1,242 | - | |

| ⑤Waste generated in operations | 13 | 9 | 8 | 132 | 233 | - | |

| ⑥Business travel | 807 | 819 | 801 | 791 | 795 | - | |

| ⑦Employee commuting | 5,086 | 5,180 | 5,022 | 4,900 | 4,989 | - | |

| ⑧Leased assets (Upstream) | - | - | - | - | - | - | |

| ⑨Transportation and distribution (Downstream) | - | - | - | - | - | - | |

| ⑩Processing of sold products | - | - | - | - | - | - | |

| ⑪Use of sold products | - | - | - | - | - | - | |

| ⑫End-of-life treatment of sold products | - | - | - | - | - | - | |

| ⑬Leased assets (Downstream) | 530,223 | 430,553 | 332,722 | 357,058 | 352,765 | - | |

| ⑭Franchises | - | - | - | - | - | - | |

| ⑮Investments | - | - | - | - | - | - | |

| Total | 603,283 | 501,954 | 400,908 | 429,702 | 425,115 | - | |

-

*Following a review of calculation methods in March 2024, the Group has revised its Scope 3 Category 7 emissions results for FY 2019 to 2022. In line with the above revisions, it has also revised the total of emissions from FY 2019 to 2022 and the total of Scope 3 emissions.

Scope1:Direct GHG emissions by the business operator itself

Scope2:Indirect GHG emissions accompanying the use of electricity, heat and steam supplied by other companies

Scope3:Indirect emissions other than Scope 1 and Scope 2